Mizen has a set of unique tools to address regulatory obligations for financial institutions including banks, insurance companies, broker-dealers and third-party service providers. We utilize two innovative platforms that assist in managing the full lifecycle of compliance needs.

- The Mizen Compliance Management Platform (MCMP)

- The Smart Data Investigative Platform (SDIP)

These are described in more detail below.

anchor

MIZEN COMPLIANCE MANAGEMENT PLATFORM (MCMP)

The Mizen Compliance Management Platform (MCMP)* is a cloud-based, secure platform that provides robust and structured tools to centralize, manage and self-assess compliance program related processes, culture and activities.

* Powered by ViClarity

Overview

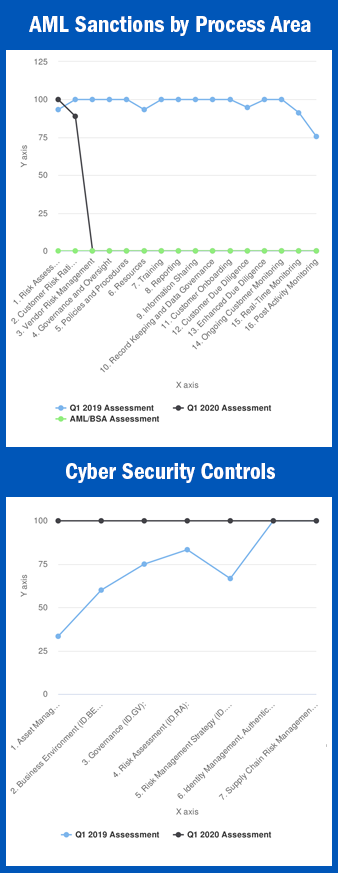

Designed by a team of regulatory, compliance and technical experts, the MCMP, powered by ViClarity, is a versatile platform that houses Mizen diagnostics and lets you manage your compliance reporting and processes in a centralized manner.

- Filtering and reporting capabilities generate custom reports at the click of a button to address the needs of various stakeholders, e.g., board of directors, auditors, regulators and/or compliance officers, and risk managers.

- Remediation efforts can be tracked and managed from inception to completion with full management visibility and an easy-to-follow, color-coded dashboards.

- Retain supporting documentation related to each process diagnostic and upload evidence where required and demonstrate compliance at any point in time.

MCMP Capabilities

MCMP functions as a centralized platform to manage your entire compliance program and related processes.

- The various processes incorporate links to underlying legislative obligations and related regulatory guidance, enabling clients to assess the extent to which their compliance programs address applicable legal requirements and/or meet regulatory expectations.

- By clicking on the relevant links, users can cross-check specific requirements and advisories.

- Clients can also upload documents where required and demonstrate evidence of compliance at any point in time.

- Dashboards and reports can be customized to users’ desired views and exported in PDF or Excel format as required. The platform also supports the generation of executive summaries and recommendations upon request.

The MCMP is supported by an experienced research team to guide users through the process. The team also ensures that the content and assessment methodology are kept up-to-date to reflect any changes to regulatory obligations or expectations.

anchor

SMART DATA INVESTIGATIVE PLATFORM (SDIP)

The Smart Data Investigative Platform (SDIP)* provides extensive e-discovery functionality to perform enhanced forensics to support any investigation in financial services, law firms or investigative practices.

* Powered by Desilian

Overview

This unique platform provides extensive e-discovery functionality to perform enhanced forensics and due diligence to support any investigation in financial services, law firms or investigative practices.

By consolidating structured and unstructured data to enrich, monitor and visualize connections or anomalies, it assists in converting masses of big data into actionable information.

SDIP Capabilities

The SDIP allows you to:

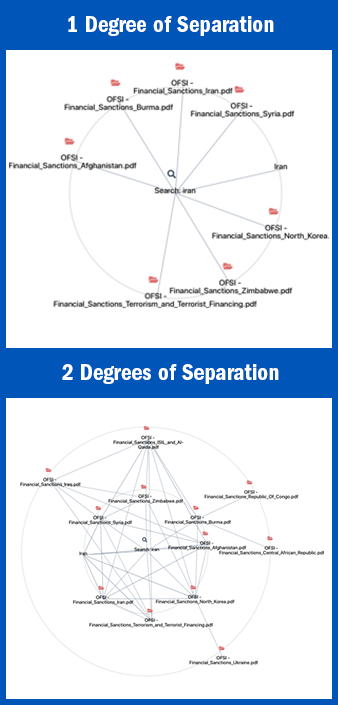

- Monitor and validate transactions, layering on intelligence and visualization tools to infer linkages among people, institutions and places that are at the center of every investigation

- Integrate with additional proprietary data sources, to validate and track relationships with your customers’ customers or counterparties and link by addresses

- Collect metrics to measure and understand risks to your institution. By consolidating all structured and unstructured data to enrich, monitor and visualize connections or anomalies, we turn the masses of Big Data into actionable information

Designed to be robust, flexible and easy-to-use, the SDIP capitalizes on mature big data techniques and proprietary algorithms to make multi-sourced data usable and intuitive. To be used either in an independent Financial Intelligence Unit (FIU) or to undertake an internal look-back at selected branches or customer segments, this customizable platform can:

- use OCR and indexing to ingest large volumes of structured and unstructured digital information, including business intelligence from public sources that shows individual and entity, such as UBO, linkages,

- contextualize unstructured date using natural language processing,

- create customized and intuitive data visualization,

- create and manage alerts that indicate changes where attention is required, and

- provide full case management and audit trail for every investigation.