Category Archives: Standard page

Platforms

Mizen has a set of unique tools to address regulatory obligations for financial institutions including banks, insurance companies, broker-dealers and third-party service providers. We utilize two innovative platforms that assist in managing the full lifecycle of compliance needs.

- The Mizen Compliance Management Platform (MCMP)

- The Smart Data Investigative Platform (SDIP)

These are described in more detail below.

anchor

MIZEN COMPLIANCE MANAGEMENT PLATFORM (MCMP)

The Mizen Compliance Management Platform (MCMP)* is a cloud-based, secure platform that provides robust and structured tools to centralize, manage and self-assess compliance program related processes, culture and activities.

* Powered by ViClarity

Overview

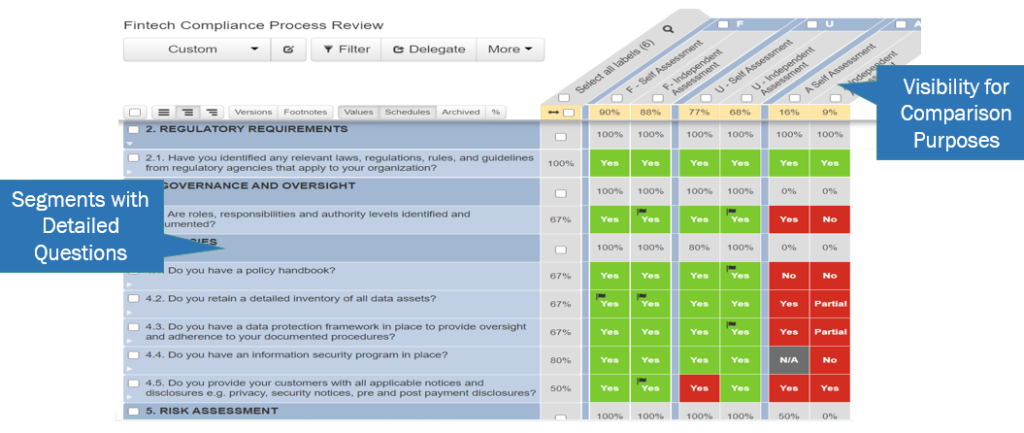

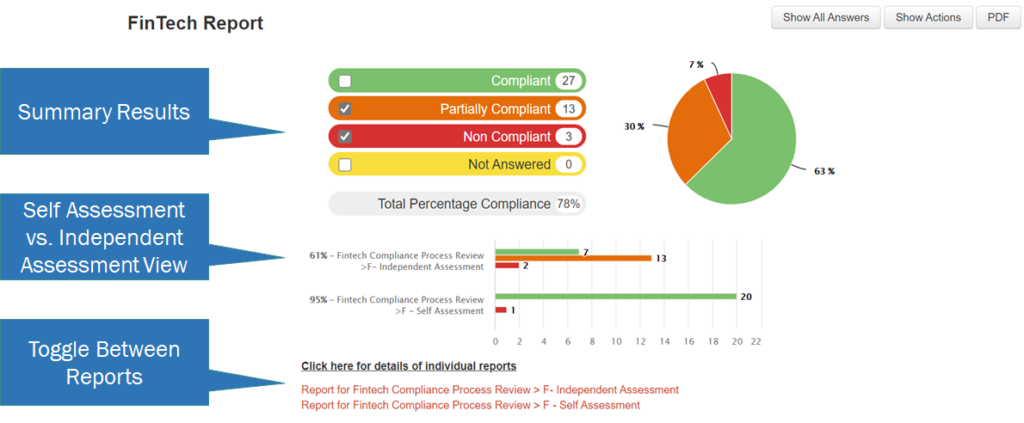

Designed by a team of regulatory, compliance and technical experts, the MCMP, powered by ViClarity, is a versatile platform that houses Mizen diagnostics and lets you manage your compliance reporting and processes in a centralized manner.

- Filtering and reporting capabilities generate custom reports at the click of a button to address the needs of various stakeholders, e.g., board of directors, auditors, regulators and/or compliance officers, and risk managers.

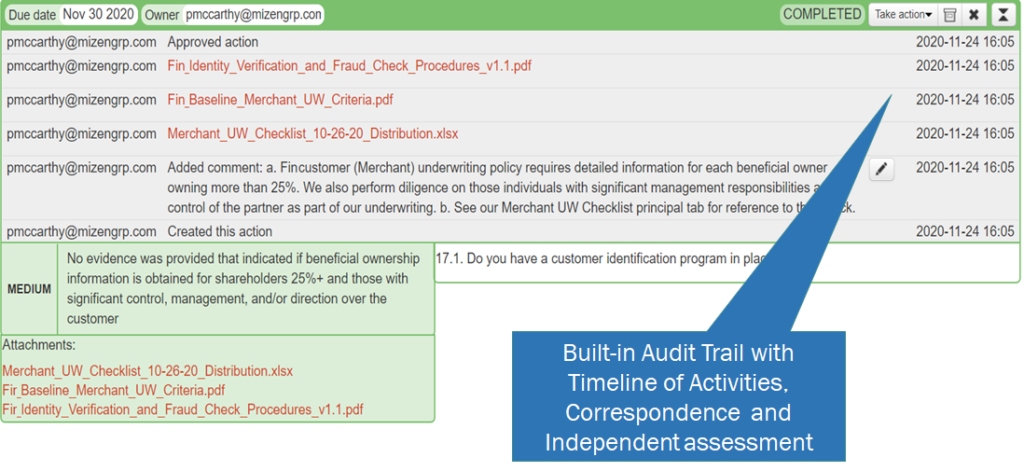

- Remediation efforts can be tracked and managed from inception to completion with full management visibility and an easy-to-follow, color-coded dashboards.

- Retain supporting documentation related to each process diagnostic and upload evidence where required and demonstrate compliance at any point in time.

MCMP Capabilities

MCMP functions as a centralized platform to manage your entire compliance program and related processes.

- The various processes incorporate links to underlying legislative obligations and related regulatory guidance, enabling clients to assess the extent to which their compliance programs address applicable legal requirements and/or meet regulatory expectations.

- By clicking on the relevant links, users can cross-check specific requirements and advisories.

- Clients can also upload documents where required and demonstrate evidence of compliance at any point in time.

- Dashboards and reports can be customized to users’ desired views and exported in PDF or Excel format as required. The platform also supports the generation of executive summaries and recommendations upon request.

The MCMP is supported by an experienced research team to guide users through the process. The team also ensures that the content and assessment methodology are kept up-to-date to reflect any changes to regulatory obligations or expectations.

anchor

SMART DATA INVESTIGATIVE PLATFORM (SDIP)

The Smart Data Investigative Platform (SDIP)* provides extensive e-discovery functionality to perform enhanced forensics to support any investigation in financial services, law firms or investigative practices.

* Powered by Desilian

Overview

This unique platform provides extensive e-discovery functionality to perform enhanced forensics and due diligence to support any investigation in financial services, law firms or investigative practices.

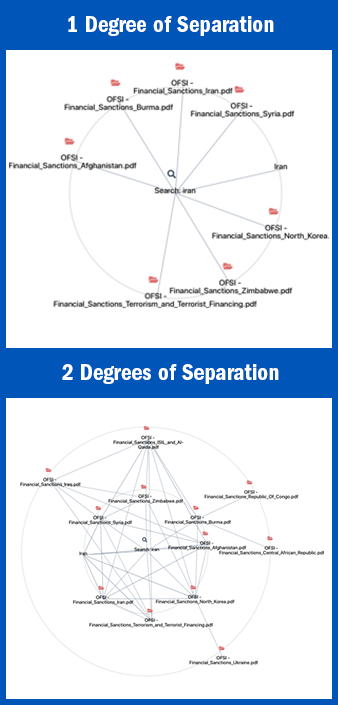

By consolidating structured and unstructured data to enrich, monitor and visualize connections or anomalies, it assists in converting masses of big data into actionable information.

SDIP Capabilities

The SDIP allows you to:

- Monitor and validate transactions, layering on intelligence and visualization tools to infer linkages among people, institutions and places that are at the center of every investigation

- Integrate with additional proprietary data sources, to validate and track relationships with your customers’ customers or counterparties and link by addresses

- Collect metrics to measure and understand risks to your institution. By consolidating all structured and unstructured data to enrich, monitor and visualize connections or anomalies, we turn the masses of Big Data into actionable information

Designed to be robust, flexible and easy-to-use, the SDIP capitalizes on mature big data techniques and proprietary algorithms to make multi-sourced data usable and intuitive. To be used either in an independent Financial Intelligence Unit (FIU) or to undertake an internal look-back at selected branches or customer segments, this customizable platform can:

- use OCR and indexing to ingest large volumes of structured and unstructured digital information, including business intelligence from public sources that shows individual and entity, such as UBO, linkages,

- contextualize unstructured date using natural language processing,

- create customized and intuitive data visualization,

- create and manage alerts that indicate changes where attention is required, and

- provide full case management and audit trail for every investigation.

Diagnostics

CULTURE DIAGNOSTICS

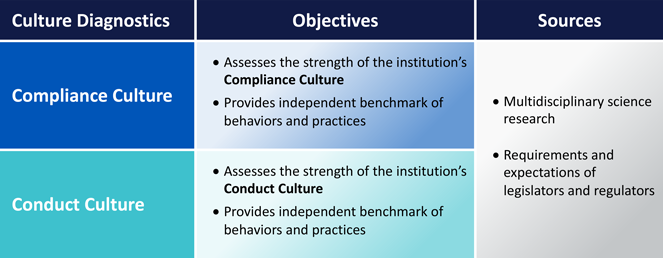

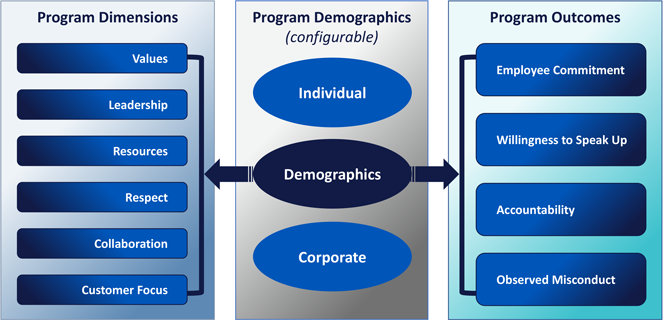

Our culture diagnostics are anonymized and independently administered survey tools that assess employee perceptions of the drivers that determine an organization’s compliance and conduct culture. We believe people’s behaviors are based on their perception of reality and the world around them which then shape expectations and behaviors.

Assessing the strength of the cultural drivers and using the results to strengthen these drivers is well-established in behavioral science research. It has formed the basis of successful change programs designed to improve outcomes across multiple domains. Our constructs of compliance and conduct culture refer to decision-making and behavior in the financial industry.

These are described in more detail below.

Compliance Culture Diagnostic

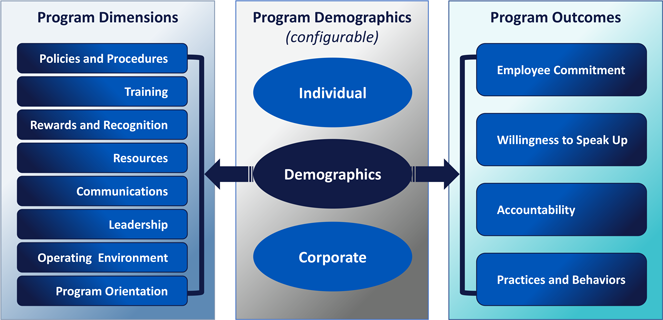

Our diagnostic is a perception-based assessment that measures the extent to which employees view the compliance culture of the institution as facilitating their compliance related decisions and behavior. It is derived from judicial imperatives, regulatory expectations and validated behavioral science studies. Our grounding concept is that a healthy compliance culture will be correlated with good compliance-related outcomes.

A 15-minute assessment is administered to all employees, designed to ensure that responses are entirely anonymous and independent of each other and tailored to the specific needs of the institution. Demographics can be segmented and evaluated by any desired breakdown, and multiple languages can be accommodated for international deployment.

Conduct Culture Diagnostic

Our diagnostic is a perception-based assessment that measures employees’ views of how their work culture supports their decision making and behavior. It has been produced through a multidisciplinary approach, which marries industry knowledge with academic rigor. Guiding our approach is the idea that healthy (functional and strong) conduct culture will be correlated with reduced employee misconduct and business conduct risk.

A 15-minute assessment is administered to employees in a way consistent with respondent anonymity. The diagnostic can be tailored to the specific needs of the institution. Data is analyzed using statistical packages and methodologies agreed upon by expert behavioral scientists.

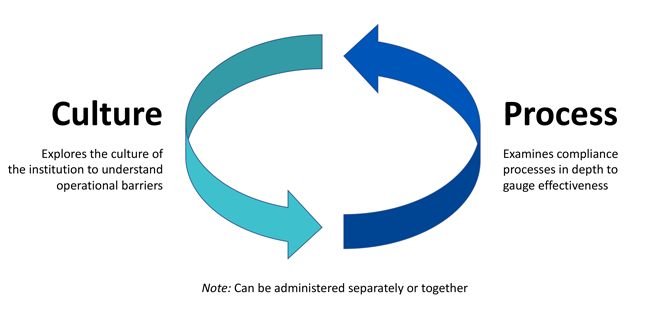

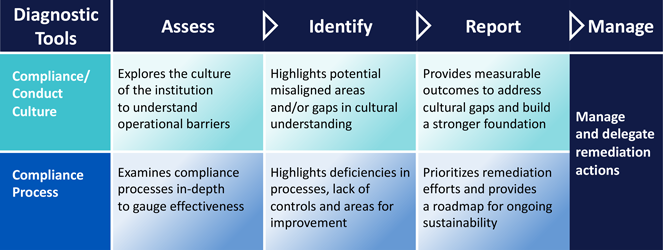

Convergence of Culture and Process

Our culture diagnostics may be combined with our process tools to manage areas of improvement or remediation actions. Our approach explores the culture of the institution to understand operational barriers as well as compliance processes in depth to gauge effectiveness and sustainability.

For more information on how culture and process converge, please contact us.

PROCESS DIAGNOSTICS

Our process diagnostics are designed to help you assess various regulatory and compliance programs. They are mapped to legislative obligations and related guidance, enabling you to evaluate the extent to which your compliance programs meet these expectations. The requirements and guidelines are identified and linked for cross-referencing to the underlying assessment questions. By clicking on relevant links, users can cross-check the actual legal requirement.

These are described in more detail below.

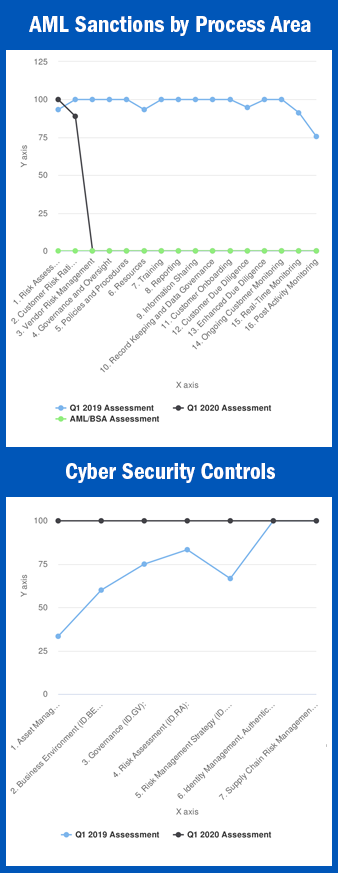

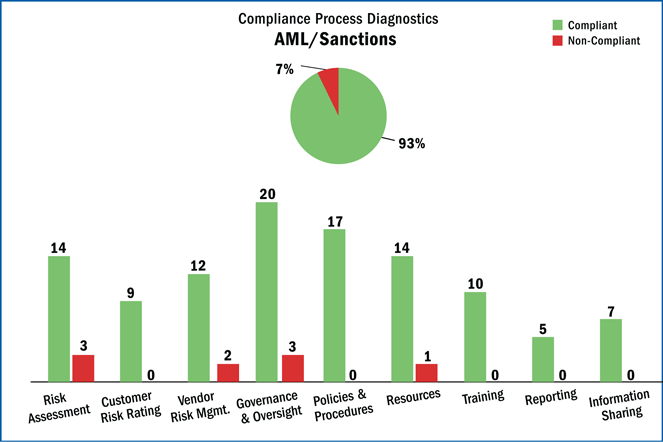

AML/Sanctions Process Diagnostic

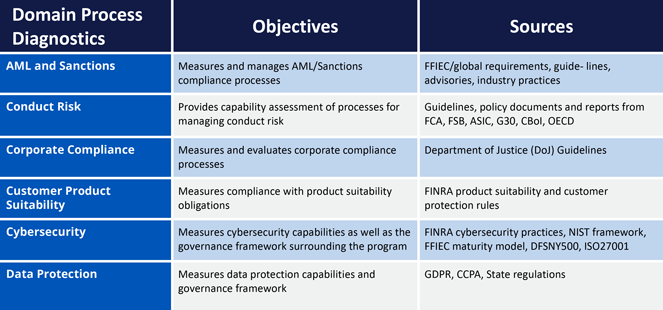

Our compliance diagnostic for AML/Sanctions consists of an evaluation of the strength of 16 different processes across four domains. Based on applicable legislation, the diagnostic reflects guidance from regulators and authoritative international bodies and incorporates regulatory expectations around best practices. This diagnostic can be tailored to address the specific business profile and regulatory obligations of each institution.

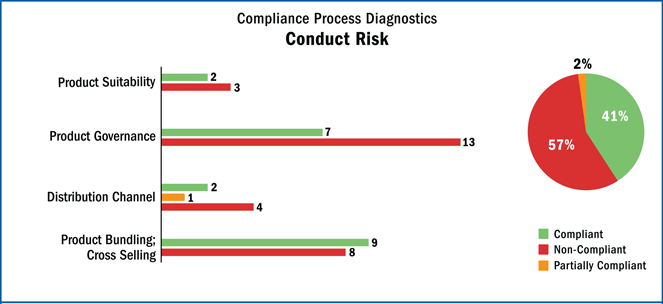

Conduct Risk Process Diagnostic

Our conduct risk process diagnostic provides capability assessment of conduct risk management. With 80+ questions overall, it has specific sections that address product governance and suitability for the retail market. The diagnostic is based on guidelines, policy documents and reports from Financial Conduct Authority (FCA), Financial Stability Board (FSB), Australian Securities and Investments Commission (ASIC), Group Thirty (G30), Central Bank of Ireland (CBoI), and Organization for Economic Cooperation & Development (OECD).

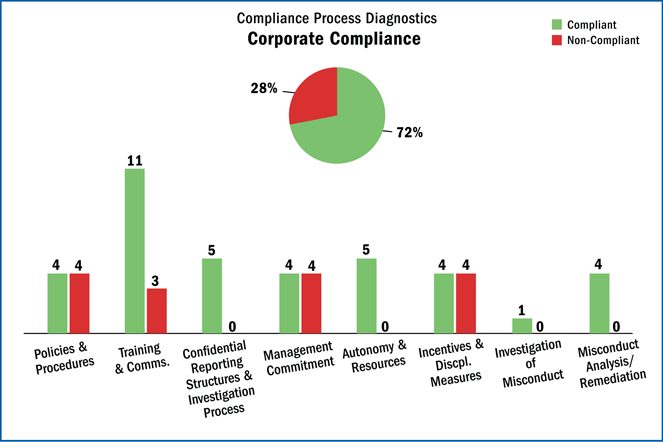

Corporate Compliance Process Diagnostic

This diagnostic evaluates the strength of a corporate compliance program. Based on DoJ regulations, the diagnostic reflects regulatory expectations around best practices. This diagnostic can be tailored to address the specific business profile and regulatory obligations of each institution.

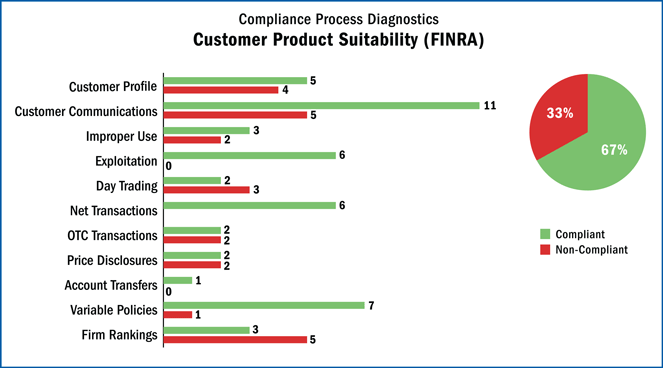

Customer Product Suitability (FINRA)

This diagnostic evaluates the process in place to ensure customer protection and suitability requirements for broker-dealers. Structured directly from the FINRA Handbook, it ties the key rules into 44 sections (e.g., customer profile, improper use, identifying conflicts of interest) to ensure that all areas covered under FINRA are identified for evaluation purposes. These are designed to help the institution determine that the right processes are in place and are sufficiently comprehensive, appropriate and robust.

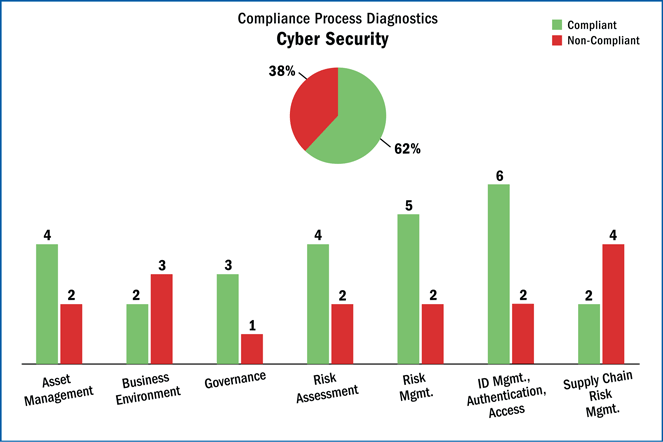

Cybersecurity

Our cybersecurity diagnostic tool supports assessment in the cyber domain in a targeted fashion. Given the high priority by regulators to cyber threats, this tool covers FFIEC regulations, NY DFS 500 and industry practices to assist in determining whether a client’s cyber security program is up-to-date to identify vulnerabilities or gaps and to pinpoint areas for remediation.

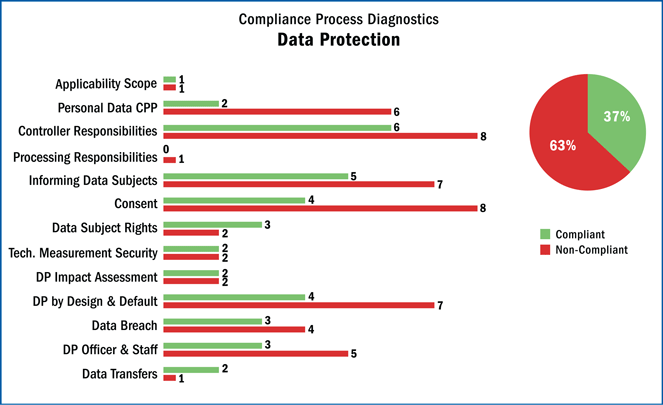

Data Protection

This diagnostic tool supports assessment in the data protection domain. Given the recent focus on protection of personal information and the passage of GDPR and CCPA, this tool has been developed to help determine whether a client’s approach to data is in compliance with GDPR and/or CCPA, depending on your institution’s needs.

Products

Diagnostics

Mizen has developed innovative diagnostic products to assist in addressing challenges faced in today’s regulatory environment. Our unique proprietary products help you conduct in-depth explorations of your compliance programs and determine gaps, inefficiencies and areas for improvement. Our approach explores the culture of the institution to understand operational barriers as well as compliance processes in depth to gauge effectiveness and sustainability. The results of culture and process diagnostics may be converged or utilized separately.

We use our diagnostics to quickly assess, remediate and validate all aspects of compliance programs with proprietary tools that reside on a state-of-the-art management platform. These support the understanding, oversight, management or implementation of compliance processes thereby reducing risk, costs, effort and time.

Our approach explores the culture of the institution to understand operational barriers as well as compliance processes in depth to gauge effectiveness and sustainability. The results of culture and process diagnostics may be converged or utilized separately.

Culture Assessments

- Assess the strength of your institution’s compliance and conduct cultures

- Provide independent benchmark of behaviors and practices

Process Assessments

- Self-assess the completeness and effectiveness of your compliance program processes:

- AML and Sanctions

- Conduct Risk

- Corporate Compliance

- Customer Product Suitability

- Cybersecurity

- Data Protection

Fintech Registry

The Fintech Registry is a secure cloud-based portal that provides Compliance as a Service (CaaS) to Fintech firms and serve as a marketplace for banks to engage with them. Coming Soon!

Compliance Solutions

The Mizen Approach

We have developed unique proprietary diagnostic tools to help clients address challenges faced in today’s regulatory environment. These diagnostics assist with in-depth explorations of your compliance programs and determine gaps, inefficiencies and areas for improvement. Additionally, we offer personalized advisory services in compliance domains to support you with compliance enhancement or remediation projects.

Our products, platforms and services provide solutions that ensure compliance with regulatory obligations for financial institutions including:

- Banks

- Insurance companies

- Credit unions

- Fintechs

- Broker-dealers

Mizen products may be licensed for use by all financial institutions as well as third-party providers.

Products

Diagnostics

Mizen has developed innovative diagnostic products to assist in managing compliance processes efficiently and effectively. Our diagnostics are standalone but may be used on the MCMP or your own management platform.

Our approach explores the culture of the institution to understand operational barriers as well as compliance processes in depth to gauge effectiveness and sustainability. The results of culture and process diagnostics may be converged or utilized separately.

Culture Assessments

- Assess the strength of your institution’s compliance and conduct cultures

- Provide independent benchmark of behaviors and practices

Process Assessments

- Self-assess the completeness and effectiveness of your compliance program processes:

- AML and Sanctions

- Conduct Risk

- Corporate Compliance

- Customer Product Suitability

- Cybersecurity

- Data Protection

Fintech Registry

The Fintech Registry, a cloud-based platform that provides Compliance as a Service (CaaS) to Fintech firms and serves as a marketplace for banks to engage with them. Coming Soon!

Platforms

Mizen Compliance Management Platform (MCMP)

Designed by a team of regulatory, compliance and technical experts and powered by ViClarity, the MCMP is a versatile platform that houses Mizen diagnostics and lets you manage your compliance processes in a centralized manner.

Smart Data Investigation Platform (SDIP)

This unique platform, powered by Desilian, provides extensive e-discovery functionality to perform enhanced forensic investigations and due diligence to support any investigation in financial services, law firms or investigative practices.

Services

Using our innovative products, Mizen provides a range of services to help you manage and enhance your compliance program:

- Compliance Program Assessments

- Compliance Program Design

- Culture Assessment

- Data Analytics

- Data Governance and Data Validation

- Implementation, Testing, Optimization

- Model Validation

- Outsourced CCO Solutions

- Transaction Reviews

Solutions to Regulatory Challenges

THE MIZEN ADVANTAGE

At the Mizen Group, Inc., we deploy our proprietary innovative diagnostics to quickly assess, remediate and validate all aspects of your compliance programs. Our RegTech products and advisory consulting services are designed to help mitigate the risks and reduce the costs of your institution’s regulatory compliance burdens.

Our proprietary diagnostics measure the culture of compliance and conduct and provide independent benchmarks of behaviors and practices while our compliance process diagnostics evaluate the completeness, effectiveness and sustainability of various compliance programs. In addition, we partner with innovative FinTech firms to provide our clients access to additional leading-edge compliance products.

PRODUCTS

Mizen has developed innovative diagnostic products to assist in addressing challenges faced in today’s regulatory environment. Our unique proprietary products help you conduct in-depth explorations of your compliance programs and determine gaps, inefficiencies and areas for improvement. Our approach explores the culture of the institution to understand operational barriers as well as compliance processes in depth to gauge effectiveness and sustainability. The results of culture and process diagnostics may be converged or utilized separately.

Diagnostics

Our innovative diagnostic products address challenges faced in today’s regulatory environment. Our unique proprietary products conduct in-depth explorations of your compliance programs and determine gaps, inefficiencies and areas for improvement.

These diagnostics include conduct and compliance culture assessments as well as compliance process assessments.

Fintech Registry

The Fintech Registry is a secure cloud-based portal that provides Compliance as a Service (CaaS) to Fintech firms and serves as a marketplace for banks to engage with them.

PLATFORMS

The Mizen Compliance Management Platform (MCMP)

The Mizen Compliance Management Platform (MCMP)* is a cloud-based, secure platform that provides robust and structured tools to centralize, manage and self-assess compliance program related processes, culture and activities.

Smart Data Investigative Platform (SDIP)

The Smart Data Investigative Platform (SDIP)* provides extensive e-discovery functionality to perform enhanced forensics to support any investigation in financial services, law firms or investigative practices.

SERVICES

Mizen’s differentiator lies in the use of its RegTech diagnostics for quick, precise and cost-effective assessment of your compliance program. This approach increases compliance efficiencies, targets priority items, and helps to reduce risks in the regulatory space.

Let us help you navigate the current regulatory landscape with our innovative approach and solutions! Contact us by calling (917) 267 4545, emailing info@mizengrp.com or using the Contact Us form.

Fintech Registry

Compliance as a Service (CaaS) where FinTech’s can assess and manage their regulatory obligations

FinTech Overview

FinTech Assessment Breakdown

FinTech Dashboard Report

Detailed Feedback & Workflow

Services

Using our innovative products, Mizen provides a range of services to help you manage and enhance your compliance program:

Compliance Program Assessments

Evaluate your program to identify any gaps or areas for improvement. The assessment can be tailored to specific needs or specific regulatory requirements of the institution, e.g., NY DFS 504, NY DFS 500, FINRA 3310.

Compliance Program Design

Assist in designing new compliance programs, redesigning an existing one or tailoring for a specific regulatory requirement such as DFS NY 504. Support institutions that are overwhelmed with the magnitude of obligations related to developing a program or overhauling an existing one.

Culture Assessment

To manage and influence culture, identify current attributes in order to measure it and define possible outcomes. We have combined industry experience with behavioral science best practices to assess an institution’s culture as it relates to specific regulatory considerations concerning conduct, compliance, and risk.

Data Analytics

Support AML and sanctions risk management by using sophisticated data analytics and trend analyses on transactions and account activities to gain additional insights concerning customers and account activities.

Data Governance and Data Validation

Analyze the business and system architecture and then identifying all necessary data sources. Validate if data flows appropriately and consistently into the target systems with a defined structure so the data are properly managed and maintained.

Model Validation

Specialized validation within a risk management framework for transaction monitoring and screening solutions, compliant with industry guidance, e.g., NY DFS 504, OCC 2011-12 and SR 11-7.

We also perform model validation to Artificial Intelligence (AI) solutions applying innovative approaches and methodologies.

Outsourced CCO Services

Advanced services including outsourced CCO (Chief Compliance Officer) relationships. The intrinsic benefits of an outsourced CCO – including extensive experience, a full bench of support, and robust policies and procedures and all supported through our MCMP.

Implementation, Testing, and Optimization

Implement AML monitoring and sanctions filtering systems with appropriate rigor to cover the risks to the institution; assess existing and/or customize new rules (detection scenarios), conduct above/below the line testing of existing thresholds.

Transaction Reviews

Perform historical reviews of transactions whether under regulatory mandate or as proactive risk mitigation. Mizen employs a unique strategy to analyze transactions and identify the look-back period appropriately using our SDIP.

Knowledge Center

White Papers

Articles of Interest

At Mizen, we believe in being part of the conversation about today’s corporate world. Regulators are increasingly emphasizing the role culture and compliance play in the financial sector, as such we are highlighting news articles that we see as particularly relevant to you, our clients, and to our mission.

We curate these articles and update them frequently in order to stay current and provide insight into issues related to corporate culture. Click on the links below to go directly to the article on the original site. Mizen has no affiliations with these websites and does not get any benefit from posting these articles here.

Contact Us

Let us help you navigate the current regulatory landscape with our innovative approach and solutions! Please fill out the contact form, call us at (917) 267 4545, or email info@mizengrp.com.